An Advanced Value Strategy

The WisdomTree Siegel Strategic Value IndexTM

Powerful Innovation from Two Industry Leaders

The WisdomTree Siegel Strategic Value Index™ (the “Index”) was designed for use with the BCA® suite of Fixed Indexed Annuities (FIAs) from Athene Annuity and Life Company, including BCA 2.0. The Index is built on a proven track record of successful financial innovation from:

Professor Jeremy Siegel earned a Ph.D. from the Massachusetts Institute of Technology and is the Russell E. Palmer Professor of Finance at the Wharton School, University of Pennsylvania. He also serves as the Senior Advisor to WisdomTree Investments, Inc.

WisdomTree is a leading asset manager with over $63 billion in assets under management and offers strategies designed to combine powerful strategic insights and objective asset allocation processes.1

Proven Strategies to Help Navigate Changing Markets

The WisdomTree Siegel Strategic Value Index is designed to systematically leverage proven investment strategies with the aim to provide consistent long-term appreciation. These strategies include:

Seeking Value – Value is a well-known strategy that seeks to buy assets when the price is low and sell when the price is high. The Index seeks to systematically identify undervalued U.S. market sectors using Professor Siegel’s research.

Company Earnings – Evaluating the operating earnings of a company relative to its valuation can provide a greater understanding of its profitability, strength and value. The Index leverages operating earnings and valuation in the process to help identify the strongest undervalued sectors.

Market Trends – Trends analysis attempts to predict future bull and bear markets using historical return information. The Index attempts to use trends to capitalize on momentum when the markets are increasing and reduce exposure to the markets when they are declining.

Reducing Risk – When equity markets become volatile, shifting to a more conservative allocation can help reduce the impact of market drawdowns. The Index leverages a Market Protection Strategy with the aim to provide more consistent long-term returns.

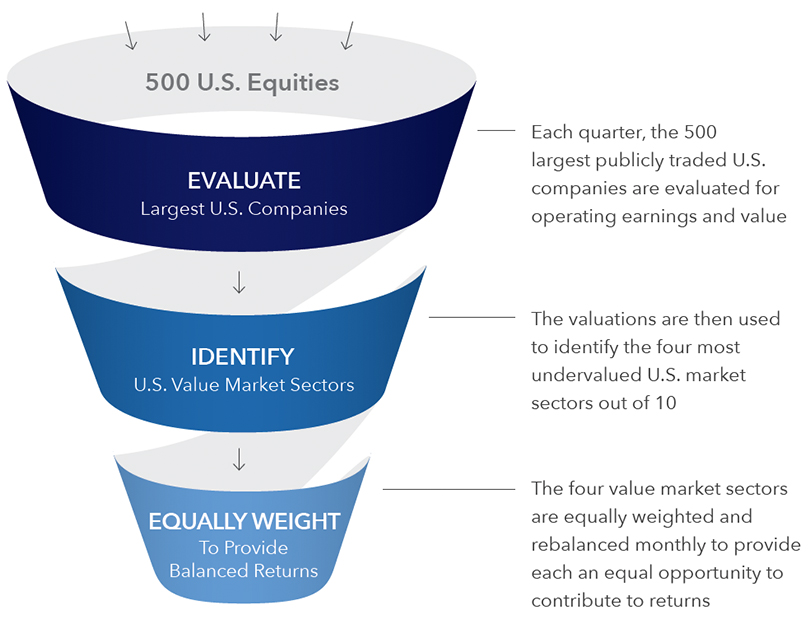

Professor Siegel’s Process for Identifying Value in the U.S. Market

The WisdomTree Siegel Strategic Value Index leverages Professor Siegel’s methodology for evaluating company earnings relative to valuation and finding the most undervalued sectors in the U.S. market each quarter. The Index selects the four value sectors quarterly, and rebalances them to an equal weighting monthly. The diagram below shows how this is applied:

Siegel Equity Index Process

The market sectors evaluated are: Information Technology, Consumer Discretionary, Communication Services, Consumer Staples, Energy, Financial, Health Care, Industrial, Materials and Utilities. Market sectors are selected on the first day of trading each January, April, July and October.

A Strategic Way to Help Protect Against Potential Market Declines

The Index includes a tactical market trend response that makes strategic allocations to provide more or less exposure to a Market Protection Strategy that is designed to insulate against market declines. The Market Protection Strategy uses an equal allocation of the Siegel Equity Index and a strategy designed to hedge market risk and provide returns when the broad market is declining.2

Market Trend Indicator

When multiple market trends are negative, the Index may allocate 100% to the Market Protection Strategy. A daily process is designed to achieve a 6% daily volatility by allocating between the tactical market trend response and an interest-free cash account. When markets are relatively stable, the Index may increase its equity allocation up to 150%.

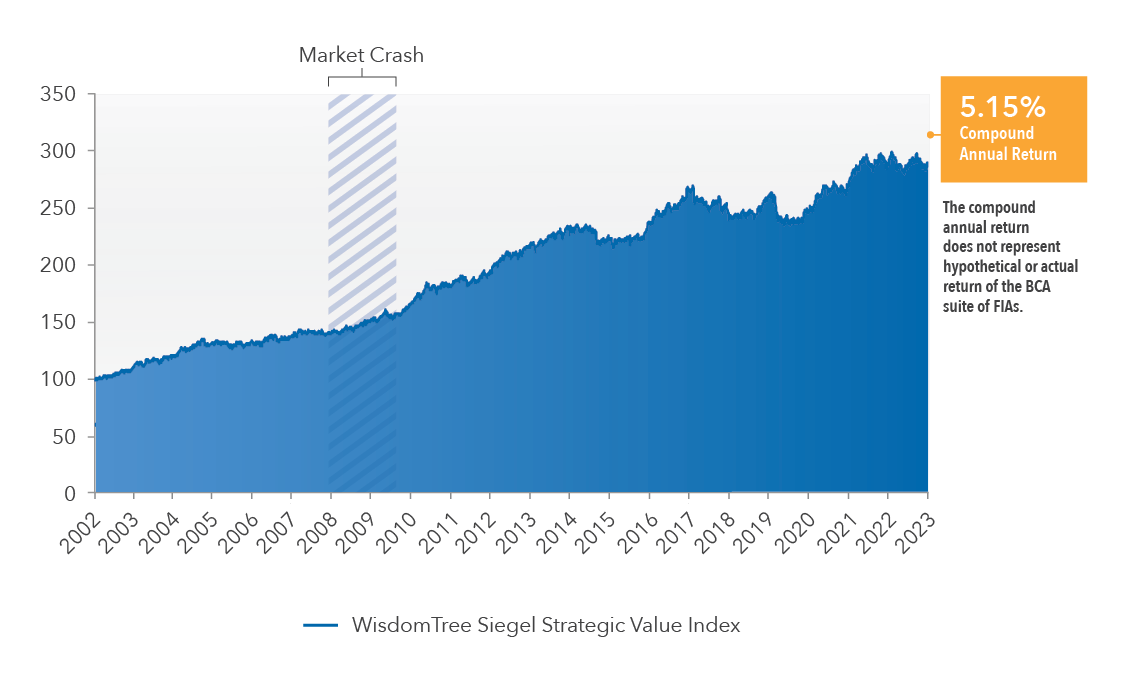

An Opportunity for Stable Long-Term Growth

The WisdomTree Siegel Strategic Value Index is designed to leverage Professor Siegel’s value market sector selection strategy with a daily market trend analysis and provide an opportunity for stable index appreciation through a variety of markets. The graph below shows this consistent growth since 2002.

A Strategy for Consistent Growth

Hypothetical Assumptions: Index value of the WisdomTree Siegel Strategic Value Index from 12/27/02 to 12/31/23. The Index was established on 12/3/18. Performance shown before this date is back-tested by applying the index strategy, which was designed with the benefit of hindsight, to historical financial data. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of nor does it guarantee future performance. The foregoing performance information does not include any relevant costs, participation rates, and charges associated with the BCA suite of FIAs or the Index. For more information on the BCA suite of FIAs with the Index, ask your insurance professional for an illustration.

The WisdomTree Siegel Strategic Value Index is available with all BCA 2.0 FIAs. Rates and product availability will vary by state and results may be higher or lower. See your insurance professional for detailed information.