Finding Value on a Global Scale

Shiller Barclays Global Index

Leverage Insights from a Pioneer of Value Investing and Barclays

Robert J. Shiller, Ph.D.

- Sterling Professor of Economics and Professor of Finance at Yale University

- Best-selling author of Irrational Exuberance

- One of the world’s most influential economists1

A pioneer of value investing, Professor Robert Shiller helped design a systematic way to identify undervalued assets to help investors buy when the price is low and sell when the price is high.

Professor Shiller’s Cyclically Adjusted Price to Earnings Ratio (commonly known as the CAPE® ratio) has become a benchmark for finding values among global asset classes.

With global financial services firm Barclays, Professor Shiller applied some of his latest insights to create the Shiller Global Index. Barclays has a quantitative research team that worked closely with Professor Shiller to develop the methodology. This global, multi-asset index is designed to leverage diversification, value investing and momentum to create consistent appreciation through a variety of markets.

Key Terms and Resources

CAPE® RATIO – A statistical tool used to identify potential values, the CAPE® Ratio compares the current price to the average earnings over 10 years, adjusted for inflation.

MOMENTUM – An indicator of a positive or negative trend in an asset’s price movement over time. Momentum is calculated by comparing the asset class’s current price to the price of the asset class six months earlier.

Finding Global Value

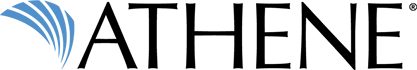

The Index is designed to provide global diversification from the world’s three largest developed markets: the United States, Eurozone and Japan. Asset classes in stocks, bonds and commodities offer opportunities for growth in a variety of market conditions.

Leverage Diversified Global Asset Classes

Individual Stocks as of 12/18. Number of individual stocks are evaluated quarterly and subject to change.

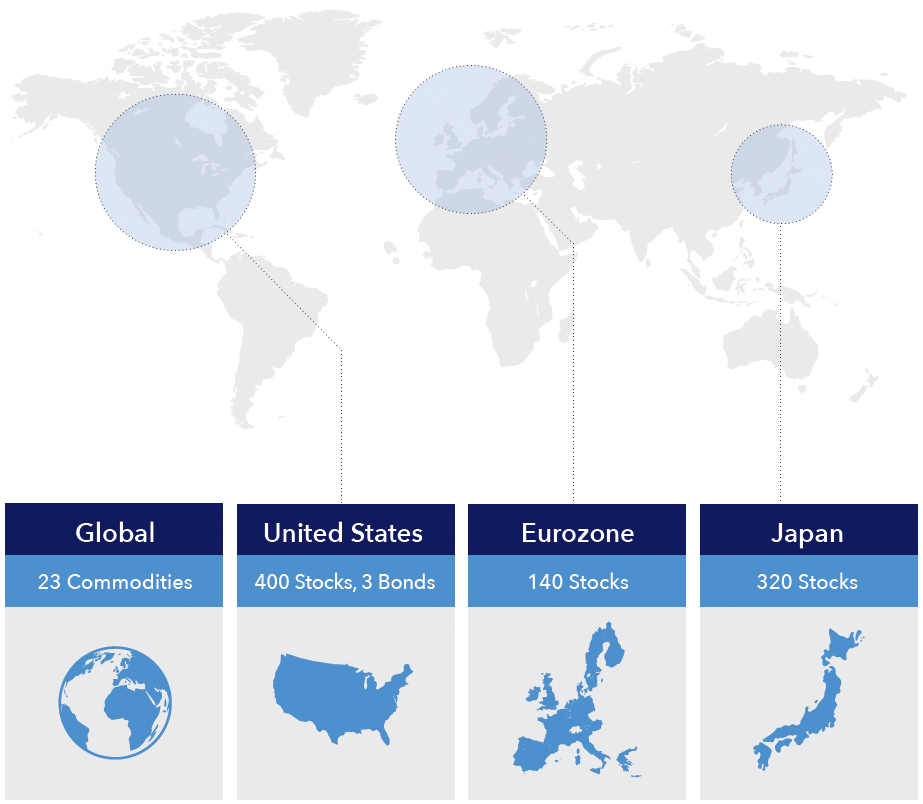

Professor Shiller’s and Barclays Process for Finding Global Value

The Index is designed to identify undervalued stocks in three regions — the U.S., Eurozone and Japan — using CAPE ratio and strongest momentum. Professor Shiller and Barlcays designed this monthly process to find stocks that are well-established and relatively forgotten, with a long history of earnings but underpriced in the market.

Identifying Best Values With Strongest Momentum

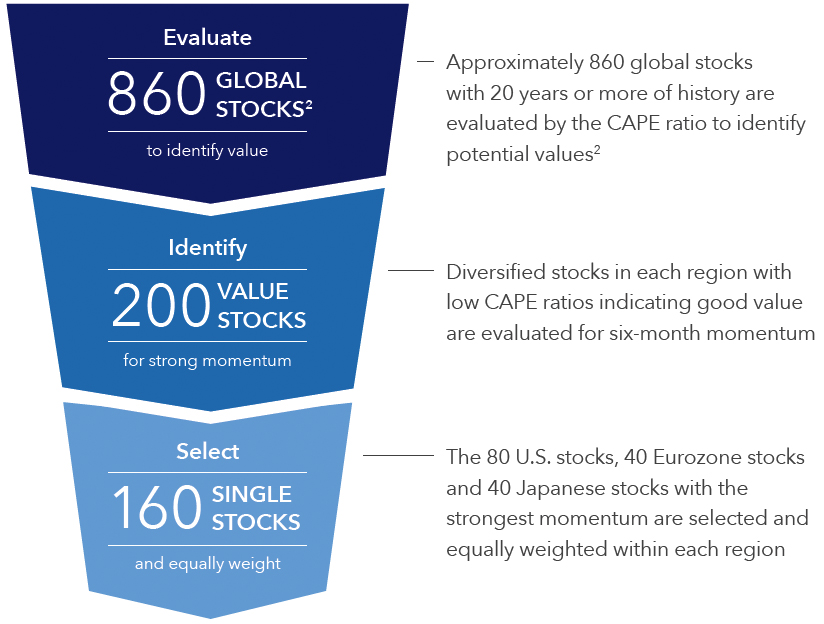

Multi-Asset Allocation

The Index evaluates and rebalances stocks, bonds and undervalued commodities monthly with the aim to respond to changing market conditions. Barclays and Professor Shiller’s global stocks are always included in the allocation, with other asset classes included when they show positive momentum.

Designed to Navigate Global Markets

The Benefit of Global Values

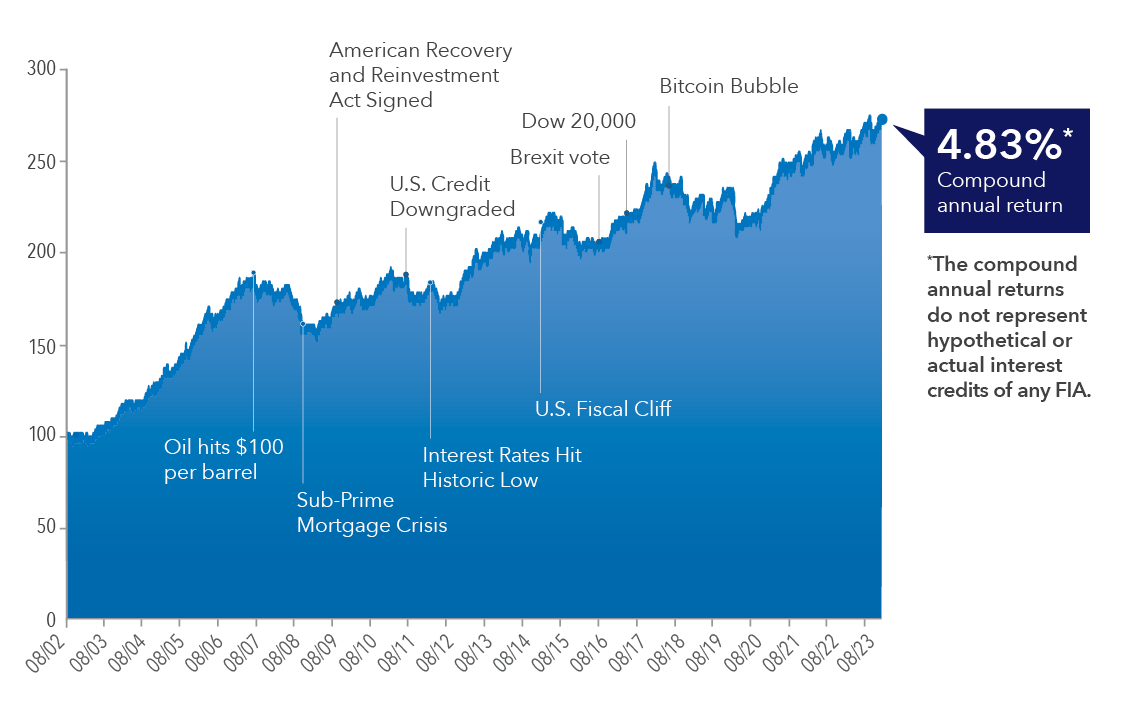

Strategies developed by Barclays and Professor Robert Shiller help allocate global asset classes using principles of value investing and momentum to create an opportunity for stable appreciation through a variety of market environments. The graph below shows how the Shiller Barclays Global Index would have performed over the more than 21 years of turbulent global markets.

Shiller Barclays Global Index

Hypothetical Assumptions: Index Value of the Shiller Barclays Global Index from 8/1/02 to 12/31/23. The Shiller Barclays Global Index was established on 2/1/19. Performance shown before this date is back-tested by applying the index strategy, which was designed with the benefit of hindsight, to historical financial data. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of nor does it guarantee future performance or results. The foregoing performance information does not include any relevant costs, participation rates and charges associated with the BCA suite of FIAs or any other financial product linked to the Shiller Barclays Global Index. For more information on the BCA suite of FIAs and performance of the Shiller Barclays Global Index, ask your insurance professional for an illustration.

The Shiller Barclays Global Index is available with all BCA 2.0 FIAs. Rates and product availability will vary by state and results may be higher or lower. See your insurance professional for detailed information.